On February 22, 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update® (ASU) 2017-05 to clarify the scope of asset derecognition guidance and provide new guidance on the accounting for partial sales of nonfinancial assets.

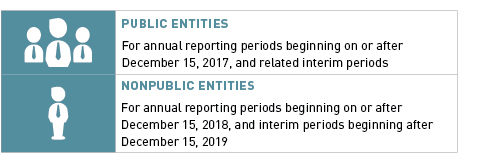

The update provides greater detail on what types of transactions should be accounted for within the scope of FASB Accounting Standards Codification® (ASC) Subtopic 610-20. Effective dates for this update are the same as those for the new revenue recognition standard, ASU 2014-09, Revenue from Contracts with Customers (Topic 606):

- Public entities. Annual reporting periods beginning after December 15, 2017.

- All other entities. Annual reporting periods beginning after December 15, 2018.

The update is intended to reduce the complexity of current GAAP requirements by clarifying which accounting guidance applies to various types of contracts that transfer assets or ownership interests to another entity. The changes are expected to most significantly impact the real estate industry but may also affect other industries including power and utilities, alternative energy, life sciences, and shipping.

Background

ASC Subtopic 610-20 was created in May 2014 in conjunction with the issuance of ASU 2014-09. ASC Topic 606 provides accounting guidance on how to account for revenue from contracts with customers, but it doesn’t apply to contracts with noncustomers—in other words, contracts for goods or services that aren’t an output of the entity’s ordinary activities. ASC Subtopic 610-20 was introduced to bridge this gap and provide guidance on transfers of nonfinancial assets that aren’t an output of an entity’s ordinary activities. In doing so, the new guidance introduced a new, undefined term: in substance nonfinancial asset.

Because the term was undefined, the FASB received feedback that stakeholders were uncertain about which types of transactions should be accounted for under ASC Subtopic 610-20. Additionally, the new guidance didn’t address partial sales of nonfinancial assets—a common occurrence in the real estate industry.

To address these and other concerns, the FASB expanded an existing project on clarifying the definition of a business. The project was split into three phases, two of which are now complete:

- Phase one. Clarify the definition of a business in ASC Topic 805. This was completed in early 2017 through the issuance of ASU 2017-01.

- Phase two. Clarify the scope of ASC Subtopic 610-20, including the term in substance nonfinancial asset, and provide guidance for partial sales. ASU 2017-05 represents the completion of this phase.

- Phase three. Determine whether there are differences in accounting for the acquisition and derecognition of assets and businesses that can be eliminated. The FASB is currently in initial deliberations on this phase.

Key Provisions

Key provisions of ASU 2017-05 are outlined below.

In Substance Nonfinancial Assets

In substance nonfinancial asset is defined as a financial asset promised to a counterparty in a contract if substantially all of the fair value of the assets promised within the contract is concentrated in nonfinancial assets. In other words, if substantially all of the fair value of the assets promised in the contract is concentrated in nonfinancial assets, then all of the financial assets included in the contract are considered in substance nonfinancial assets. This definition also applies to the transfer of ownership interests in a subsidiary that isn’t considered a business.

Scope of ASC Subtopic 610-20

ASC Subtopic 610-20 applies to the recognition of gains and losses on transfers to noncustomers of the following:

- Nonfinancial assets

- In substance nonfinancial assets

This includes the transfer of ownership interests in a subsidiary that isn’t considered a business if all of the assets in the subsidiary are nonfinancial assets or in substance nonfinancial assets.

Under the revised guidance, all entities are required to account for the derecognition of a business or nonprofit activity in accordance with the derecogntion guidance in ASC Topic 810, Consolidation. In other words, businesses and nonprofit activities are excluded from the scope of ASC Subtopic 610-20.

The update also eliminates a previous scope exception from ASC Topic 860, Transfers and Servicing, that exempted equity method investments considered to be in substance nonfinancial assets from being accounted for under that topic. Accordingly, equity method investments are also excluded from the scope of ASC Subtopic 610-20.

Recognition

When an entity transfers nonfinancial assets to a counterparty in a contract and determines it doesn’t have—or ceases to have—a controlling financial interest in the legal entity holding the transferred assets, then the contract should be evaluated under the criteria provided in ASC Subsection 606-10-25-1. If the contract meets the criteria, each distinct nonfinancial asset should be derecognized when the entity transfers control of the asset to the counterparty. Consideration should be allocated to each distinct nonfinancial asset by applying the guidance in ASC Topic 606 on allocating the transaction price to performance obligations.

Assets shouldn’t be derecognized when an entity determines that it has—or continues to have—a controlling financial interest in the legal entity holding the transferred assets.

In cases where the entity has—or continues to have—a noncontrolling interest in the legal entity holding the transferred nonfinancial assets, the entity should determine the point in time in which the legal entity obtained control of each distinct asset. The noncontrolling interest received—or retained—from the counterparty should be considered noncash consideration and measured in accordance with ASC Subsections 606-10-32-21 through 24.

Effective Dates and Transition

ASU 2017-05 follows the same adoption timeline as ASU 2014-09 (as amended by ASU 2015-14).

Entities may apply the guidance as early as annual reporting periods beginning after December 15, 2016, including related interim reporting periods. However, an entity is required to apply the update at the same time it adopts ASC Topic 606.

We're Here to Help

For any questions or to better understand how this new standard may affect your business, contact your Moss Adams professional. A decision flowchart for ASC Subtopic 610-20 is also available for management to consider when evaluating whether assets promised to a counterparty in a contract should be derecognized.